Business

Maintaining Brand Credibility While Optimizing at Scale for Online Retail

Key Takeaways

- Consistency in brand messaging across all platforms fosters trust and recognition. Retailers that maintain clear, unified communication craft a sense of professionalism that reassures customers.

- High-quality content and transparent communication enhance brand credibility. Delivering educational and accurate information to your audience keeps your brand at the forefront of their minds.

- Leveraging social proof and customer reviews builds consumer confidence. Proof from other buyers or respected voices increases the perceived reliability of your offerings.

- Implementing robust data protection measures safeguards customer trust. Secure handling of data eliminates one of the key risks that can break consumer confidence.

In the fast-paced world of online retail, successfully scaling operations is not just a growth strategy—it’s a necessity to remain relevant in a constantly evolving digital marketplace. As retailers expand to reach new customers, markets, and territories, they often face immense pressure to deliver faster, offer a wider range of products, and enhance the user experience. However, this rapid growth presents risks: with each new sales channel or campaign, there’s a chance that inconsistencies may creep in, policies might become unclear, or the brand’s core message gets diluted. These missteps can erode the brand credibility that may have taken years to establish. Therefore, scaling in online retail isn’t simply about growing bigger or faster; it’s about doing so in a way that solidifies, rather than sacrifices, long-term trust. Employing smart strategies such as SEO for eCommerce websites allows retailers to expand their reach while reinforcing their reputation for reliability, dependability, and quality across multiple platforms.

Brand credibility is more than a buzzword—it represents the foundation upon which loyal customer relationships are built. Loyal buyers return not just for your products, but for the assurance that your brand delivers on its promises. A lapse in message consistency, quality of service, site security, or transparency can erode that trust rapidly, sometimes irreversibly. It’s tempting to prioritize short-term sales spikes during rapid expansion phases, but sustainable growth always incorporates a long-view of brand stewardship. Weaving protection of your brand’s reputation into every step of your growth journey ensures your business doesn’t just scale; it thrives, evolves, and retains the loyalty of its most valuable supporters.

Consistency in Brand Messaging

Brand credibility hinges on maintaining consistent messaging, tone, and visuals across every platform—from product pages, FAQs, and checkout processes to digital advertisements, social media profiles, and email campaigns. When your brand voice is distinctive yet harmonious everywhere it appears, it projects professionalism, stability, and attention to detail. This coherence not only streamlines customer interactions but also builds a sense of familiarity and trust, encouraging customers to return and recommend your brand to others. Even small discrepancies—such as outdated product descriptions, mismatched promotional graphics, or inconsistent metadata—can create confusion, leading customers to hesitate or look elsewhere. For this reason, every expansion effort should include rigorous checks to ensure all communication aligns with your established brand guidelines. Maintaining consistency is among the most powerful drivers of brand awareness, and it can significantly influence how customers perceive and trust your company. As your brand grows, regularly reviewing your assets and messaging across channels becomes increasingly critical to maintaining the essence of what makes your business unique and trustworthy.

High-Quality Content Strategy

Consistently publishing valuable, accurate, and engaging content helps establish your brand as an industry authority. This includes blog posts that answer questions, tutorials that showcase expertise, comprehensive guides, and videos on essential topics. Such helpful information positions your company as a dependable resource throughout the customer journey, from initial contact to post-purchase support. Maintaining a regular content schedule enhances SEO and fosters stronger relationships with both customers and search engines. Updating blogs and resource pages signals your relevance, expertise, and ongoing dedication to your audience. High-quality content also makes complex topics easier to understand, reducing customer confusion and support inquiries. Clear messaging builds trust in your brand as a reliable authority, boosting both trust and engagement. Regular content audits ensure your digital presence consistently reflects your brand’s best qualities.

Leveraging Social Proof

Customers crave validation that your products meet their expectations, especially in competitive sectors that are saturated with similar offerings. Social proof—like user reviews, testimonials, and star ratings—offers this assurance. Prominently showcasing genuine feedback on product and checkout pages not only builds credibility but also gives new customers the confidence to act. Going beyond basic reviews, user-submitted photos, detailed stories, and even social media shout-outs helps personalize and humanize your brand. Partnering with respected influencers and industry experts whose missions align with your own extends your message to a broader audience. These relationships are especially valuable when the endorsements feel organic, reflecting absolute satisfaction or excitement for what your business offers. Featuring well-documented case studies or ‘before and after’ results can also move buyers closer to conversion. With many consumers researching peer feedback before making a purchase, a comprehensive and ongoing strategy for collecting and displaying social proof can substantially increase your conversion rates and establish your brand as trustworthy in a crowded market.

Transparent Communication

Openness is a powerful currency in digital retail. Customers value brands that communicate honestly—whether explaining pricing, announcing service updates, or responding to inquiries. These habits foster mutual respect, showcasing your brand values beyond mere transactions. Regular updates via newsletters, blog posts, order notifications, or support channels reassure shoppers, even when sharing less-than-ideal news, such as stock shortages or delays. Transparency sets realistic expectations, helping earn forgiveness and maintain relationships during disruptions. Ultimately, brands that prioritize openness are more likely to secure long-term loyalty, as customers feel valued, informed, and connected beyond the purchase.

Data Protection Measures

As online shoppers increasingly prioritize privacy and data security, brands must adopt robust protection strategies to maintain trust. Clearly explaining data collection and sharing policies in privacy notices is crucial. Implementing secure payment methods, such as SSL certificates, demonstrates a commitment to customer safety. Adhering to regulations like GDPR and CCPA is vital, as security breaches can significantly damage a reputation. Ongoing staff training on digital risks and regular system audits bolster security. Transparency regarding these measures fosters stakeholder trust, while regular reviews and updates strengthen protection efforts, thereby enhancing the company’s reputation and boosting consumer confidence.

Conclusion

Scaling up as an online retailer presents immense opportunities to expand your customer base, introduce new products, and explore innovative technologies. However, growth should always be pursued alongside a vigilant commitment to brand credibility, since a single misstep at scale can be far more costly to rectify. Success follows when retailers reinforce consumer trust at every interaction, remaining steadfastly consistent, transparent, and proactive—not only with content and communication, but also in matters of data security and customer relationship management. By emphasizing high-quality content, embracing the authenticity of social proof, and fostering open and honest dialogue, your retail operation won’t just grow; it will thrive, earning loyalty and becoming a benchmark for reliability in the increasingly crowded digital marketplace. With careful stewardship of both reputation and innovation, your brand can stand out as a trusted leader and secure both immediate and longstanding competitive advantage.

READ ALSO: Modern Food Display Trends and Their Impact on Customer Choices

Business

Creating Year-Round Outdoor Living Spaces: Trends and Tips

Key Takeaways

- Prioritize sustainable materials for style, resilience, and environmental impact. Durable, responsibly sourced products mean fewer replacements and less waste.

- Use smart technology to maximize convenience and efficiency outside. Automated lighting, irrigation, and even entertainment systems let you effortlessly personalize your space.

- Design multi-use spaces that can quickly adapt to different needs and seasons, increasing both enjoyment and value for your home.

- Invest in weather protection to keep your outdoor areas comfortable year-round, so they remain inviting whether it’s scorching summer sun or a winter chill.

- Integrate biophilic design to strengthen your connection to nature and enhance well-being, no matter the size of your outdoor area.

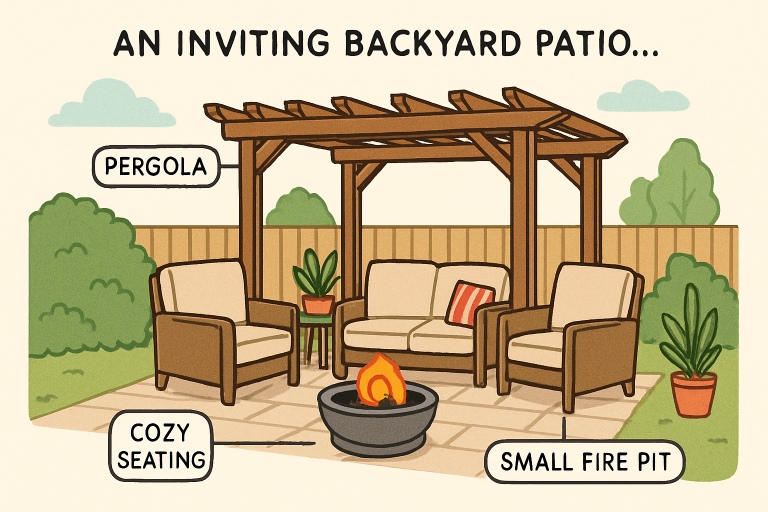

Outdoor living spaces have evolved far beyond simple patios or decks used only in pleasant weather. They’re now thoughtfully designed components of a home’s living area that can be enjoyed year-round. Homeowners are increasingly seeking to blur the boundaries between indoor comfort and outdoor beauty, creating backyard retreats that provide the perfect setting for both relaxation and entertaining, regardless of the season. Whether you’re gathering friends for a cozy fall evening around a flickering fire pit or enjoying a refreshing spring brunch under a pergola draped in greenery, the options are endless for creating an inviting outdoor oasis. Aluminum extrusions Winter Park, FL, for instance, specialize in screen rooms, sunrooms, and pool enclosures, offering durable, low-maintenance solutions that keep these spaces attractive and functional for many years.

The way people use their homes is shifting, with a heightened focus on comfort, functionality, and wellness. As more individuals spend time at home, there’s a growing demand for outdoor environments that reflect personal style, offer flexibility, and provide sustainable solutions. Today’s outdoor retreats are not merely open spaces they frequently feature advanced smart technologies, convenient multi-use furniture, and weather-tough materials. These improvements mean patios, decks, and gardens can serve as everything from offices and gyms to outdoor cinemas or dining rooms, adjusting as needs, moods, or seasons change. The push for sustainability is also front and center, as homeowners become increasingly aware of their environmental footprint and seek responsible, lasting enhancements for their outdoor living areas.

Sustainable Materials and Eco-Friendly Design

Sustainability is shaping the next generation of outdoor living spaces, as homeowners increasingly choose responsible, eco-friendly materials for their projects. Options like reclaimed wood, recycled metals, and natural stone not only reduce environmental impact but also lend unique character and enduring strength to patios, decks, and furniture. These materials naturally withstand the elements and bring an organic, timeless elegance to outdoor environments. Landscaping with native or drought-resistant plants is another highly effective way to enhance sustainability; these plants require less watering and fertilizer and tend to thrive with minimal maintenance, keeping gardens lush and vibrant year-round while conserving resources. According to Architectural Digest, features such as green roofs, living walls, and edible gardens are seeing surging popularity, not just for their environmental benefits but also for their ability to provide fresh food and improve air quality right outside your door. With thoughtful choices, you can create a beautiful space that’s gentle on the planet and enjoyable for decades.

Smart Outdoor Technology

Technology is transforming the experience of outdoor living, making it more convenient, personalized, and enjoyable than ever before. App-controlled lighting lets you create the perfect ambiance for any occasion, from a romantic evening under the stars to a lively summer gathering with family and friends. Automated irrigation systems ensure your gardens and lawns remain healthy without the hassle of manual watering, while weather-responsive shades automatically adjust to changing conditions, shielding you from the midday sun, then retracting for evening breezes. Consider integrating speakers, security cameras, and Wi-Fi extenders to create a connected, secure, and entertaining environment that extends your digital lifestyle beyond your home. Imagine hosting a dinner party where, with a simple voice command, soft lighting glows, music plays, and the heaters warm the space. These comforts are no longer a futuristic luxury but a smart investment that both enhances your quality of life and increases your home’s value.

Multifunctional Outdoor Spaces

Modern outdoor spaces are designed to serve multiple purposes, providing flexibility to adapt as your lifestyle or needs evolve. For instance, dividing your backyard into specific zones, a grilling area with a built-in outdoor kitchen, a dining nook sheltered by a pergola, a relaxing lounge with plush, weatherproof sofas, and even a tucked-away reading corner, enables you to switch easily from family meals to entertaining guests, or from quiet solitude to celebratory gatherings. This zoning approach enhances the entire area’s usability, ensuring every inch is purposeful year-round. Weather-resistant furniture, modular designs, and clever storage solutions are key, keeping these spaces tidy and inviting regardless of activities or changing seasons. By planning layouts that support everything from gardening and playtime to working outside and hosting events, you can create a backyard that truly adapts to how you live, work, and play year-round.

Weather Protection and Seasonal Comfort

Enjoying your outdoor space, regardless of the weather, requires strategic weather protection and comfort enhancements. Installing sturdy pergolas with retractable canopies or louvered roofs means you can control sunlight and shelter with minimal effort. Adding outdoor heaters and fire pits makes cool autumn nights and chilly winters comfortable and inviting, extending your time outside. For summer heat, consider large umbrellas, awnings, or shade sails that can be repositioned as the sun moves across the sky. Using outdoor curtains, windbreaks, and high-quality weather-resistant cushions and fabrics ensures not only year-round usability but also a cozy, personalized feel. According to Houzz, there’s a growing preference for heated patios and all-weather furniture, reflecting a strong movement toward creating outdoor living spaces that are as comfortable and usable as any room inside the house. By investing in these features, homeowners can ensure their outdoor retreats are sanctuary-like havens even during less-than-perfect weather.

Biophilic Design Elements

Incorporating biophilic design into your outdoor living space means intentionally fostering a stronger, daily connection with nature. Consider the calming influence of a water feature, whether it’s a small fountain, a pond, or a modern reflecting pool, or the visual delight of a living plant wall, which can also improve air quality and provide privacy. Natural textures and earthy finishes, such as wood decking, stone walkways, and rattan furniture, add warmth and authenticity to the space, enhancing your sense of peace and relaxation. Even with limited square footage, such as a city balcony, vertical planters, hanging baskets, and a mix of leafy greens can create a lush, vibrant sanctuary. These biophilic touches not only enhance the visual appeal and serenity of your outdoor area, but studies also show they help reduce stress and support mental well-being, making your garden or patio a restorative escape from the pace of everyday life.

Planning for Seasonal Transitions

Getting the most from your outdoor space means thinking ahead and planning for how you’ll use it throughout the year. Fall is a strategic time to start upgrades or renovations: you can lay new patios, install essential infrastructure, and pick climate-appropriate plants well before winter sets in. This proactive approach allows your space to rest and settle over the colder months, putting you ahead of the spring rush and ensuring everything is ready to enjoy as soon as warm weather arrives. Consulting with landscape designers or outdoor architects or using online planning resources can help you navigate decisions about materials, layouts, and plantings, making the entire process more manageable. A clear plan also ensures you stay on budget and avoid costly last-minute changes during peak renovation seasons.

Conclusion

Year-round outdoor living is about thoughtfully merging design, technology, and nature to create a versatile and inviting space. By prioritizing sustainable materials, incorporating smart outdoor technologies, creating multifunctional layouts, and ensuring comfort with effective weather protection, you can transform any backyard or patio into a personal haven that welcomes you in every season. With careful planning, your outdoor living area becomes more than an occasional escape; it’s a lasting investment in comfort, sustainability, and countless cherished memories throughout the year.

READ ALSO: How Modern Window Designs Contribute to Energy-Efficient Homes

Business

Modern Challenges in Commercial Locksmith Services

Business security is evolving rapidly as threats become more sophisticated and technology advances. The days of simply relying on sturdy deadbolts or mechanical locks to secure a business are behind us. Today, professionals focused on commercial locksmith services Orlando are navigating a landscape shaped by digital innovation, complex regulatory requirements, and heightened expectations for rapid, reliable service. Owners and facility managers now face tough decisions about protecting property, data, and employees by integrating next-generation systems that require both traditional and electronic expertise.

With features like mobile-managed smart locks and advanced biometric authentication, modern security brings new layers of convenience and control—but also introduces potential vulnerabilities. As a result, locksmiths are called upon not only for their ability to replace hardware but also for their expertise in electronic integration, auditing, and cybersecurity best practices. Keeping assets safe in this changing environment means partnering with professionals who understand not just the mechanics, but also the digital and regulatory complexities unique to the commercial sector.

Evolution of Commercial Locksmithing

Over the past decade, the commercial locksmithing industry has undergone significant changes. Where once locksmithing was a trade rooted in metalworking and mechanical skills, today’s professionals must also be proficient in technology deployment and networked security solutions. Business needs have shifted from basic access protection to complex systems that incorporate real-time monitoring, customizable access levels, and detailed audit trails. Global demand for high-level security, as highlighted by the New York Times, continues to drive innovations and investments in new security tech for businesses of all sizes.

Technological innovation in the field responds directly to the growing sophistication of security threats. Physical break-ins are now complemented by digital attempts to bypass poorly-secured networks or exploit outdated access systems. This shift requires that locksmiths approach their work holistically, prioritizing both physical barriers and the technology supporting them.

Integration of Smart Locks and Biometric Systems

Modern businesses require seamless access control, and the adoption of smart locks and biometric systems has accelerated rapidly to meet this need. Smart locks, controlled remotely or through networked devices, enable business owners and managers to conveniently oversee access privileges—granting, revoking, or modifying access through intuitive interfaces. Biometric authentication, such as fingerprint or facial recognition, is now a standard feature for high-security areas, delivering a personalized layer of protection that reduces the risk posed by lost or duplicated keys.

These new solutions benefit organizations by offering enhanced security and sophisticated reporting capabilities, but they also introduce increased complexity. Proper integration of these advanced systems requires locksmiths to understand networking, device compatibility, and data security. This new reality is underscored by resources like ScienceDirect, which details both the advantages and the potential pitfalls of biometric security in the enterprise context.

Cybersecurity Concerns in Modern Locksmithing

As locks and access controls become more networked and intelligent, cybersecurity is now as relevant as hardware durability. While smart locks offer robust security features, any internet-connected device is a potential vulnerability. Hackers can exploit weak encryption or outdated firmware to bypass electronic locks unless strong cybersecurity protocols are in place. This means locksmiths must be adept at configuring these systems, updating devices, and educating clients on safe practices—entering the territory traditionally associated with IT professionals.

A successful modern locksmith must have a working knowledge of digital encryption, secure wireless protocols, and network authentication. The integration of physical and digital security has become essential to reduce the risk of both traditional and cyber-based threats.

On-Demand Locksmith Services

The expectations for rapid service have never been higher in the commercial sector. On-demand locksmith services are now a staple, providing fast solutions for emergencies such as lockouts, breakdowns, or system malfunctions. Mobile units equipped with sophisticated diagnostics and cutting-edge tools ensure that businesses experience minimal downtime, improving operational continuity and reducing vulnerability to further incidents.

This shift aligns with broader trends in business services, where immediacy and efficiency are crucial to customer satisfaction and operational trust. Commercial locksmiths capable of rapid response and on-the-spot solutions are becoming essential partners for businesses that rely on fluid, uninterrupted access.

Regulatory Compliance and Industry Standards

The responsibility for compliance with local, state, and federal regulations related to security falls heavily on business owners—often with significant penalties for violations. Commercial locksmiths play a critical advisory role, recommending and installing systems that satisfy legal and industry standards. This can include Americans with Disabilities Act (ADA) compliant locks, devices that capture secure audit logs, or systems built to withstand environmental hazards covered by building codes, as discussed in several regulatory analyses published by Thomson Reuters.

Maintaining compliance is not just about avoiding fines—it’s about safeguarding reputation, assets, and the continuity of business operations. Keeping up with regulatory changes ensures both legal protection and a competitive edge.

Training and Education for Modern Locksmiths

Technological advances and continually shifting regulations require locksmiths to commit to ongoing education. Specialized training in cybersecurity, innovative systems integration, and evolving safety codes helps ensure that professionals remain effective partners in securing commercial properties. Industry certifications and participation in continuing education, whether through manufacturer programs or independent courses, are essential in maintaining the required expertise.

This investment in training ensures that locksmiths can serve businesses with up-to-date, innovative solutions, while also reinforcing trust in a sector where reliability is paramount.

Future Trends in Commercial Locksmith Services

The future of commercial locksmithing is being shaped by artificial intelligence (AI), automation, and sustainability. AI-powered security systems will soon enhance threat detection and enable predictive responses tailored to the unique needs of each premises. Environmentally friendly locking options, such as those made from recycled materials, appeal to businesses committed to green practices and social responsibility. As systems become more intuitive and efficient, the role of locksmiths will expand to include ongoing support and consultancy for businesses navigating new technologies and security landscapes.

In summary, commercial locksmith services are evolving in response to technological progress, regulatory complexity, and customer expectations for convenience and safety. Businesses seeking comprehensive security solutions should look for locksmiths who embody this modern, multifaceted approach—blending time-tested skill, technological savvy, and deep regulatory insight to secure the future of business security.

READ ALSO: Top 7 Spray Foam Insulation Companies in New Jersey

Business

How to Maintain Your Monument Sign for Long-Term Durability

Introduction

Monument signs play a crucial role in establishing a business’s presence, delivering both visibility and lasting first impressions. From the moment a customer sees your sign, the quality and upkeep of that sign shape their perception of your organization. Investing in a high-quality monument sign is just the beginning—keeping it in pristine condition ensures your brand remains inviting and professional over the years. A well-maintained monument sign creates an image of reliability and attention to detail, helping your business stand out from competitors and attract new clients. Whether your business is newly established or well-rooted in the community, learning the proper maintenance techniques for your monument sign Portland can save costs and preserve curb appeal. When you prioritize care and upkeep, you also reinforce your business’s values and dedication to excellence in all aspects of your operation.

Longevity depends on more than just the initial materials and construction quality. Even the best-built monument signs can show signs of neglect if not cared for regularly. Proactive and regular care can help you avoid expensive repairs and postpone costly replacements, ultimately saving your business significant money in both the short and long term. This guide outlines essential maintenance practices for maximizing the durability of your monument sign while preserving its aesthetic presence and functionality as a local landmark. Following these guidelines also demonstrates respect for your community, as a neat and well-kept sign contributes positively to the neighborhood landscape and local pride.

Regular Cleaning

Environmental exposure causes layers of grime, dust, pollen, and pollution to accumulate on your sign’s surface. Not only does this obscure lettering and graphics, but dirt can also cause gradual material breakdown and permanent staining. Over time, neglecting simple cleaning routines can result in faded colors and damage to expensive finishes. Establish a gentle quarterly cleaning routine using non-abrasive cloths with mild soap and water—always avoiding cleaners with harsh chemicals or the use of pressure washers, which can strip away protection and cause microdamage. Focus on gentle circular motions to prevent scratching any painted or coated areas. If you encounter hard-to-remove contaminants like sap or bird droppings, consult your manufacturer’s recommendations before using specialized cleaning products, as improper cleaning agents can cause permanent damage to surfaces.

Don’t forget to clean the base, as it often encounters mud, landscaping debris, and excess moisture. Thoroughly rinsing the base and surrounding area not only keeps your monument sign looking its best but also helps prevent rot or mold from setting in around the foundation.

Inspect for Damage

Frequent inspections can be the difference between simple fixes and costly overhauls. Environmental stressors, such as temperature fluctuations, strong winds, and accidental impacts, can create weaknesses that develop over time. Carefully check for hairline cracks, chipping paint, surface rust, or flaking finishes. Pay extra attention to areas around joints, mounting hardware, and the base structure, as these are the most prone to developing issues first. Prompt detection enables you to take swift action, mitigating risks that could compromise both appearance and structural integrity. If you spot any signs of pest infestations, such as insects or burrowing animals, act immediately to prevent further deterioration. Tighten any loose fasteners and schedule repairs as soon as wear signs appear. Addressing small issues promptly protects your long-term investment and can help you avoid more significant, expensive repairs in the future.

Address Weathering Effects

Seasonal exposure to rain, sunshine, wind, and freezing temperatures can accelerate the fading, corrosion, or weakening of materials. Over the years, UV rays can bleach colors and cause brittleness in plastics or paint, while prolonged wet conditions can lead to rust on metal components and discoloration on stone or brick. Protecting your sign involves periodically applying UV-protective finishes and compatible water-resistant sealants. Look for products designed for your monument sign’s specific materials to prevent discoloration and block moisture intrusion. Regularly treating exposed surfaces prolongs their life and prevents costly restoration or premature replacement. For especially sun-exposed or rain-prone locations, these protective measures are crucial for preserving color vibrancy and extending the life of both metal and composite signs. Regular touch-ups keep signs looking fresh, ensuring your message remains clear and attractive year-round.

Maintain Lighting Components

Signs with illumination demand routine checks to ensure consistent brightness and uninterrupted visibility at night. Even minor lighting failures can have a significant impact, rendering your sign less effective or causing key information to be overlooked by nighttime visitors. Replace dimming, flickering, or burnt-out bulbs swiftly, and regularly dust or clean fixture covers to optimize light output. Regular light maintenance also helps prevent electrical shorts or premature fixture failures caused by the accumulation of dirt, debris, or moisture. Besides bulb replacements, licensed professionals should inspect electrical wiring and connections annually to prevent potential malfunctions and safety hazards, such as short circuits or electrical fires. Upgrading to energy-efficient LED lighting not only reduces the frequency of maintenance but can also lower energy costs over time. LED lighting is also more durable and generally requires less frequent replacement.

Landscape Management

Vegetation around your monument sign can become a double-edged sword. While planting adds visual appeal and can soften the appearance of stone, brick, or metal, unchecked growth can block signage, trap moisture, and cause physical damage to both the sign and its foundation. Overgrown plants may even encourage rodents or insects that can undermine the sign’s structure. Trim back shrubs, overhanging branches, and invasive vines on a regular basis. Remove leaves, branches, and debris from around the base to prevent rot and discourage mold growth. Maintaining a tidy perimeter also reduces slip-and-fall risks for pedestrians and preserves good drainage around the sign. If landscaping forms part of your sign’s presentation, work with professionals to plan and maintain a layout that enhances, rather than hides or jeopardizes, your signage. Careful plant selection, mulching, and irrigation planning can minimize maintenance needs while keeping your sign visible and accessible throughout the year.

Protective Measures

Monument signs in areas subject to vandalism or frequent severe storms benefit from extra protection. Applying anti-graffiti coatings that allow spray paint or markers to be washed away easily can save significant labor and restore your sign’s appearance quickly after incidents. Physical barriers—such as decorative fencing, bollards, or dense landscaping—can prevent direct impact from vehicles or provide windbreaks that help the sign withstand harsh weather. These measures not only help deter damage but also send a signal that your business prioritizes upkeep and security. Adding protective lighting or surveillance cameras can further reduce the risk of vandalism and crime, providing you with peace of mind and helping to discourage repeat offenses. Consider local climate and neighborhood conditions when selecting deterrents, and consult with signage professionals for tailored recommendations.

Professional Maintenance

Annual professional inspections complement your own routine efforts by addressing details you might miss. Sign maintenance specialists can reseal surfaces, refinish weathered paints, ensure structural soundness, and address deeper electrical issues that may not be apparent to the untrained eye. They bring expertise, specialized tools, and an eagle eye for trouble spots, providing peace of mind and catching early warning signs before they become costly problems. Annual professional service is especially advisable for larger, customized, or illuminated monument signs where safety and compliance are paramount. A professional’s trained assessment can also help you stay compliant with local codes and leverage the latest in sign protection technology, ensuring your business is represented at its best at all times.

Final Thoughts

Maintaining your monument sign through attentive cleaning, periodic checks, preventive weatherproofing, and professional help ensures your investment endures the elements and daily wear. From enhancing public perception of your brand to preventing costly repairs, consistent care not only protects your brand’s public face but also maximizes return by extending the sign’s usable life, reducing costs, and continually drawing eyes to your business. These efforts foster a positive public image and keep your location prominent and inviting for both existing and potential customers. Implement these practices today to enjoy a reliable and attractive monument sign for many years to come, safeguarding the value you’ve invested in this essential element of your business identity.

YOU MAY ALSO LIKE: How to Maintain Your Commercial Roofing: Essential Tips for Longevity and Durability

-

Home Improvement1 year ago

Home Improvement1 year agoEasy Ways to Clean and Maintain Your Foam Play Mat

-

Celebrity1 year ago

Celebrity1 year agoWho Is Andrew Santino Wife? The Full Story

-

Tech1 year ago

Tech1 year agoExplore iZoneMedia360 .Com Features & Benefits

-

Entertainment1 year ago

Entertainment1 year agoRemembering Melanie Olmstead Yellowstone’s Unsung Hero

-

Uncategorized1 year ago

Uncategorized1 year agoPrairie Dog Guide: Habitat, Behavior, and Conservation

-

Celebrity1 year ago

Celebrity1 year agoA Deep Dive into Jeremy Allen White Movies and TV Shows

-

Apps & Games1 year ago

Apps & Games1 year agoThe Pizza Edition Games: A Perfect Slice of Fun and Flavor

-

Business1 year ago

Business1 year agoHow Influencersginewuld Shapes the Future of Branding